Toronto’s Home Energy Loan Program

As a top General Contractor in Toronto, BVM Contracting has worked with clients that have accessed renovation financing from a variety of sources. One great way to access renovation financing AND do right by the environment for your next home renovation is with The City of Toronto’s Home Energy Loan Program (HELP). This program allows eligible homeowners to access up to $75 000 as a low-interest loan from the City of Toronto to help pay for eligible home energy improvements.

Eligible HOME ENERGY IMPROVEMENTS

The following is a list of eligible improvements that can be covered by a loan from the Home Energy Loan Program:

High-efficiency furnaces/boilers/air conditioners

Air-source heat pumps*

Window / door replacements*

Basement/attic/exterior wall insulation

Air sealing (e.g. weather stripping or caulking)

Geothermal systems*

High-efficiency water heaters

Tankless water heaters

Drain-water heat recovery systems

Toilet replacements

Solar hot water systems*

Electric vehicle charging stations (Level 2)

Rooftop solar PV panels*

Battery storage

*Qualifies for 20 year amortization

Find out here about which home improvements gives you the best return on your investment and do not break the bank!

The HELP program offers low interest loans, up to 20 year amortizations on eligible upgrades, and the loan can be paid off at any time! Of course there are eligibility requirements for the program so before you look too far into this program please look through the eligibility requirements below, as well as some information about the application process.

HOMEOWNER Eligibility

You may qualify for a low-interest loan through HELP if:

you own a detached, semi-detached, or row house;

all of the property owners on title consent to participate in the program;

your property tax and utility payments to the City are in good standing; and

you obtain written consent from your mortgage lender, if applicable*.

*If your property has a mortgage, you will have to fill out a customized Lender Consent Form. Contact BVM Contracting to get access to the Lender Consent Form and start the process of getting approved by your lender for the program! The ratio of the remaining mortgage compared to the value of the home will dictate your ability to have access to this program.

It is important to understand that you are still able to access other rebates and incentives at the same time as enrolling into the Home Energy Loan Program. Take a look through some of the other rebates and incentives that you have access to in our blog, or contact us to learn more.

The Application Process

Step 1: Complete an Application Form

To access the application form, click here.

You can print and mail the application to the following address:

Home Energy Loan Program

Environment & Energy Division

City of Toronto

55 John Street, 2nd Floor

Toronto, ON

M5V 3C6

You can also complete it online and email it to homeenergyloan@toronto.ca.

Once the City of Toronto receives and approves your application, they will send you a funding offer that states the maximum amount that your property is eligible to receive through the Home Energy Loan Program (HELP).

If your home is subject to a mortgage, you will need to send your mortgage lender a letter of consent form to fill out. Your mortgage lender’s consent is required before the City can send you a funding offer. BVM Contracting can help you obtain this form and get consent from your lender, if needed.

Step 2a: Home Energy Assessment and Funding Request

Book a home energy assessment with an Energy Advisor registered by Natural Resources Canada.

The assessment will include a basement-to-attic assessment of your home’s insulation, heating and cooling systems, and detect any air leaks or drafts.

When the assessment is complete, you will receive:

A Renovation Upgrade Report with recommendations for specific improvements

An EnerGuide rating based on your home’s current energy performance

Information on available incentives and rebates

For recommendations of Registered Energy Advisors and information on incentives and rebates available for home energy assessments, click here and scroll to the bottom of the blog, or contact BVM Contracting. We work with a network of Registered Energy Advisors that will be able to HELP!

Step 2b: Submit your funding request

Determine which improvements you wish to make and get a quote from the general contractor of your choice, based on your goals, budget and recommendations of the Energy Advisor.

Your funding request will include:

a list of the improvements you intend to undertake;

details and cost estimates based on the quote from your general contractor; and

the estimated incentive and rebate amounts available to you from the utility companies.

BVM Contracting has completed many of these types of quotes and will be able to accurately price out the cost of each upgrade you decide to move forward with. We have also helped homeowners fill out the Funding Request Form to ensure that they are not missing out on any other incentives or rebates.

Click here to access the Funding Request Form.

Step 3: Property Owner Agreement

Once the City has approved your Funding Request, they will send you a Property Owner Agreement (POA), which is the funding agreement between the property owner(s) and the City.

You must sign the POA and return to the City. Once the POA is approved by the City, they can provide, if requested, up to 30 per cent of the funds to help you get your project underway.

If you are doing more renovations than the eligible items above (which is usually the case) and you are finding other ways to finance your build, visit BVM Contracting’s Financial Section of the website

Step 4: Complete your improvements and submit your project completion report

Homeowners assume full responsibility for the work performed, which includes selecting, hiring and paying the general contractor, and obtaining all required municipal and/or provincial permits, if applicable. BVM Contracting can help guide you through the permit process, if necessary.

When your project is complete, book your post-retrofit home energy assessment with your Energy Advisor. The Advisor will verify the improvements and provide a new EnerGuide rating for your home.

Submit a Project Completion Report (click here to access), signed by your Energy Advisor, along with your general contractor’s invoices and your new EnerGuide rating label. The City will then provide you with the remaining funds for your project.

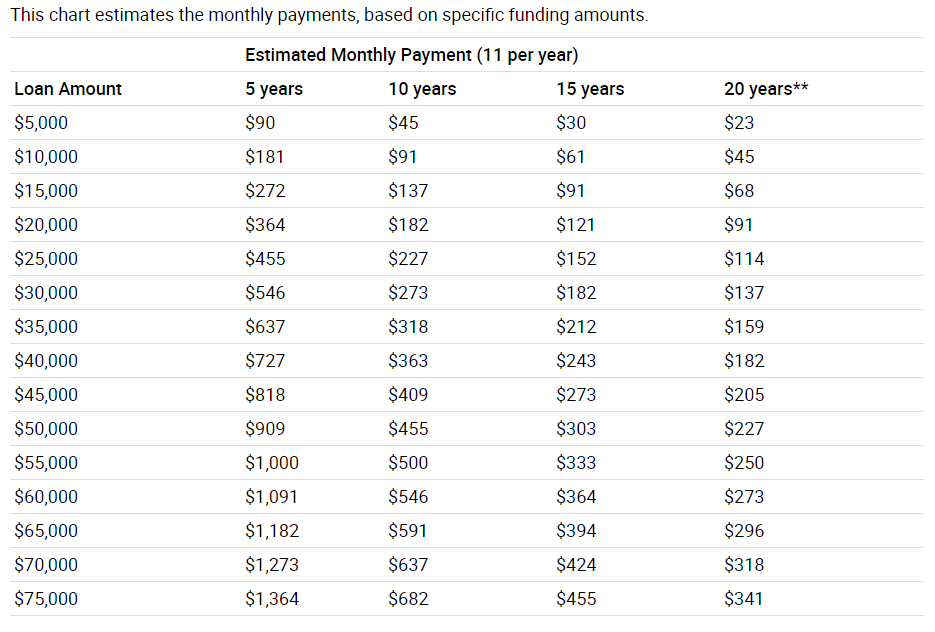

Step 5: Repay the loan over time via your property tax bill

Once your project is complete, the City will notify you when your loan payments will begin. The loan payments begin 2 months after the post-project completion date. You will be enrolled in the City’s Pre-authorized Tax Payment plan and repay the City via eleven monthly installments per year over the term of your loan. Loan payments made via the property tax bill are treated in the same manner, and subject to the same penalties, remedies and lien priorities, as property taxes.

At any time during the term of the loan, you may pay the outstanding balance, without penalty, to clear the loan from your property. Sometimes, depending on the renovations completed, homeowners can reappraise their home’s value and unlock some equity to put towards paying down the loan.

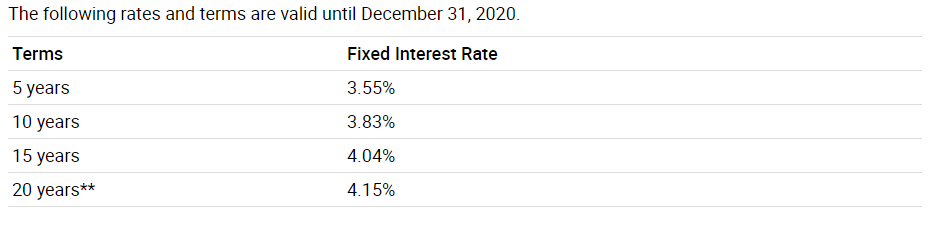

Interest Rates and Terms for The Home Energy Loan Program

The following interest rates are set for 2020 for the program:

Current interest rates for the Home Energy Loan Program

It is important to note that:

An administrative charge of two per cent (2 per cent), which reflects the City’s cost of administering the program will be added.

The value of the loan, which will include the funding amount, interest, and an administrative charge, cannot exceed 10 per cent of the current value assessment (CVA) for your property, or $75,000, whichever is less.

Homeowners will repay the loan via their property tax bill and can pay off the loan at any time without penalty.

Approximate Monthly Payment Based on Size of Loan

Reasons to Choose HELP for your Renovation Project

Enjoy low-interest rates and repayments terms of up to 20 years.

Avoid the large upfront costs of home energy improvements and pay for them over time as you save on your energy bills.

Repay the loan via installments on your property tax bill. You can pay off the loan at any time without penalty.

Receive ongoing support from the HELP team and assistance accessing additional rebates incentives from Province of Ontario and utility companies.

The loan will be attached to your property, not to you, the property owner. This means that if you sell your home before the loan is repaid, the new owner will assume the balance of the loan.

In our opinion, if you are eligible for this program you should consider filling out an application. Need some help? Contact us and we can HELP you get the process started!

BVM Contracting is committed to giving homeowners the best insight into different financing options for renovating their home. Further than providing renovation advice and industry trends, we also pride ourselves on being able to provide value to home owners before, during, and after renovations.

About BVM Contracting

BVM Contracting is a full-service General Contractor or Home Builder located in Toronto. We provide home renovation and building services for major home renovations (kitchen renovations, bathroom renovations, basement renovations, full interior renovations, home additions, and new home construction). Our goal is to help guide our clients through the process of renovating their home, from concept to completion.

Further than providing General Contracting and Project Management for major home renovations, we also offer value-added services such as renovation financing, renovation rebate consultations and services, building permit and design services, smart home installation services, and real estate investor services.

To learn more about our offering by visiting our services page.